By Ebrima S. Jallow

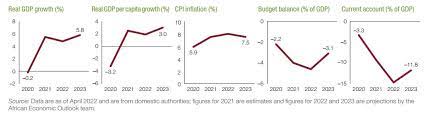

After a contraction of 0.2% in 2020 due to COVID-19, economic growth rebounded to 5.5% in 2021, on the supply side, supported by construction, trade, and tourism. On the demand side, household consumption and public investment reinforced growth. Monetary policy remained accommodative during 2020 and 2021. Inflation increased to 7.5% in 2021 from 5.9% in 2020 due to high energy prices and freight charges. The fiscal deficit increased to 4.0% of GDP in 2021 from 2.2% in 2020, reflecting higher health sector spending and subsidies to households and public enterprises to mitigate the COVID-19 shock. Public debt declined from 85.0% of GDP in 2020 to 82.9% in 2021, yet the risk of debt distress remains high.

with a fall in exports and a rise in imports, the current account deficit widened from 3.3% of GDP in 2020 to 9.3% in 2021, mainly financed by FDI and capital transfers, which also helped stabilize the dalasi. Gross official reserves increased from $352.1 million in 2020 to $496.5 million in 2021, boosted by the $85 million SDR allocation, which was used in part to finance pandemic-related spending. The financial sector remained liquid, profitable, and well-capitalized, though the shock from COVID-19 weakened asset quality. The ratio of Nonperforming Loans (NPLs) to gross loans deteriorated to 5.6% by mid-2021 from 4.5% in June 2020. The poverty rate, measured by the World Bank’s $3.20-a-day 2011 Purchasing Power Parity (PPP) line, stayed high at 35.5% in 2020 and 35.1% in 2021, due to COVID-19.

Outlook and risks

The outlook remains challenging and dependent on the global economic recovery through the tourism and trade channels. Growth is projected at 4.8% in 2022 and 5.8% in 2023, on the back of agriculture, transport, energy, tourism, finance, and the digital economy. Inflation is projected at 8.0% in 2022, driven by higher energy and food prices due to the Russia-Ukraine conflict, but it could fall to 7.5% in 2023 as global supply chains normalize. The fiscal deficit is projected to increase to 4.6% of GDP in 2022, due to higher subsidies and debt service, and then to narrow to 3.1% in 2023, owing to improved tax administration and rationalized spending. The current account deficit is forecast to widen to 14.7% of GDP in 2022, driven by infrastructure-related imports and a rising oil and food import bill due to the Russia-Ukraine conflict, then moderate to 11.8% in 2023 as reexports pick up. Downside risks could stem from new COVID-19 variants, low vaccine rollout, climate disasters, and debt vulnerabilities. Rationalizing subsidies on state-owned enterprises, strengthening the health sector, and frontloading growth-friendly structural reforms could mitigate growth risks.

Climate change issues and policy options

The country is 41 on the 2021 Global Conflict Risk Index (GCRI). Investments in climate adaptation and mitigation are vital. windstorms in 2021 affected nearly 17,000 people in 100 communities, destroyed social infrastructure, and left 100 people injured and 10 dead. The Gambia lags on green energy, with it constituting less than 2% of total energy production. However, the $86 million, 56 Mw project by the Organization for the Development of the Gambia River, a solar project targeting 1,100 schools and hospitals, constructing a 20 Mw photovoltaic plant, and a 150 Mw solar parkwill accelerate progress to the 40% green energy target and contribute to 2021’s updated Nationally Determined Contributions (NDC) target of 49.7%, both by 2030. The Gambia is on track to meet SDG 13 on climate action. Although $66 million has been mobilized, a further $1.35 billion will be required to achieve the climate targets, $420.6 million for adaptation and $925.74 million for mitigation. To leverage private finance, the government should introduce feed-in tariffs, carbon trading, clean energy subsidies, and risk management instruments to mitigate risk in low-emission and climate-resilient investments.

Ref: Africa Economic Outlook 2022